If you’re an employer with new hires or hoping to pay wages soon, you should conduct a Social Security Number verification. The IRA requires employers to verify employees’ names and SSNs on form W-2. Employers should double-check their employees’ names and SSNs before hiring.

Such verification will reveal much information about the employee, including criminal background. An employer requires SSN to prepare and fill out the W-2 form. Many states impose hefty fines on employers with fake employee information or SSN on W-2. For example, Texas companies pay about $50 for each incorrect SSN, according to the Texas Workforce Commission.

To this end, here are five ways to verify your Social Security Number.

1. Use the Self-service Option

You must sign in to an ID.me account to send a short clip or video call an agent to verify your identity. Here are the steps to take in verifying your ID and selfie.

- Go to self-service and click continue.

- Choose the type of document you wish to use for verification. Then, you can upload or take a photo of the documents.

- Make a short video selfie to confirm your identity as a person. Afterward, you can request the system to delete your biometric data.

- Input your SSN.

- Ensure all information provided is accurate before clicking submit. The system will verify your ID and send a confirmation message to protect your information against fraud.

- Select Finish to finalize the verification process. The system further shares your inputted data with the SSA.

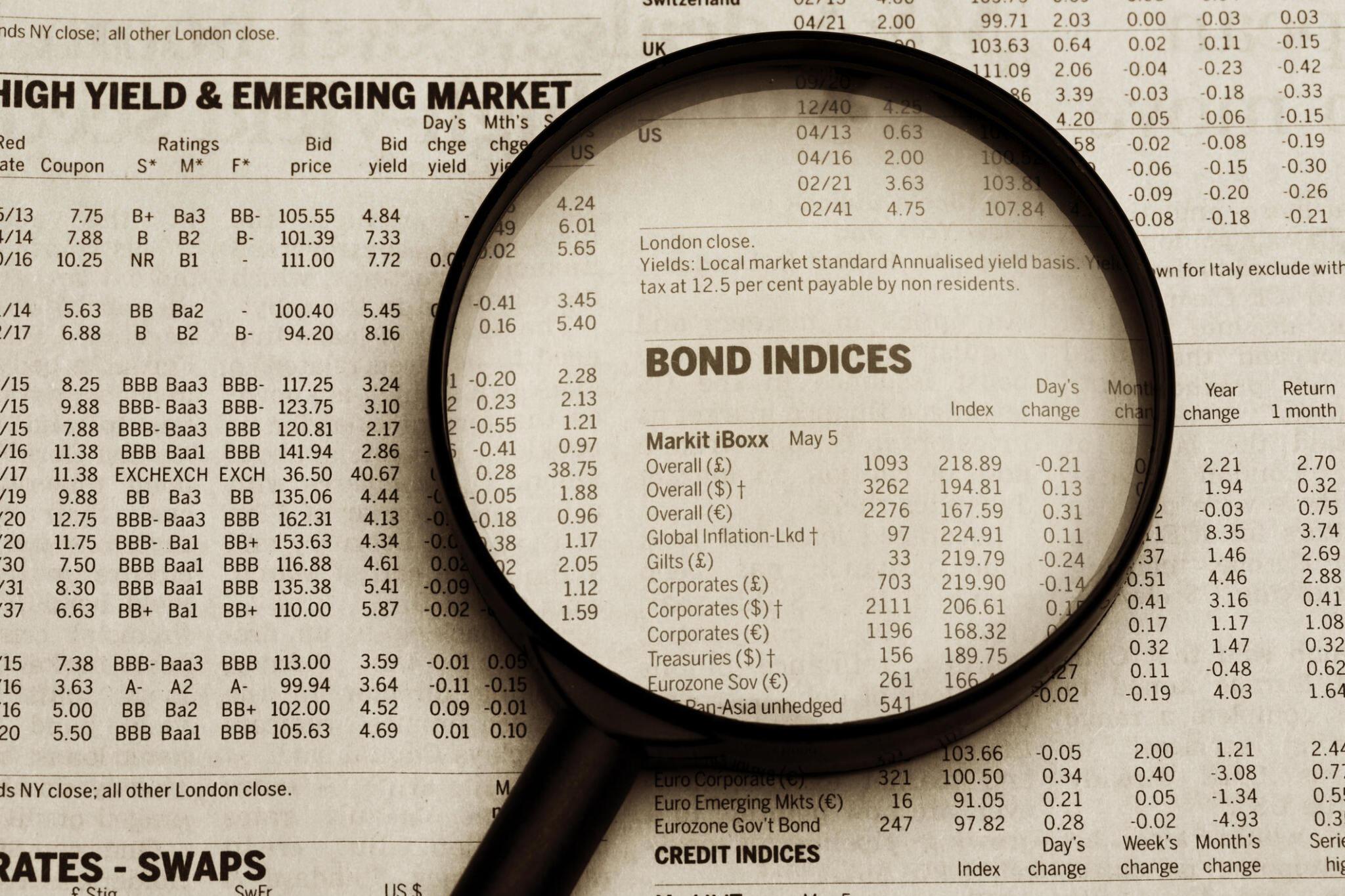

2. Social Security Number Lookup Services

Since the SSNVS is only limited to preparing and filing the W-2 form and not checking employees’ ID, credit score, and other personal information, employers looking to track down their employees can consider using an SSN verification API tool.

ked with Experian’s File One database providing current information concerning a client.

Another magnificent tool is the Social Security Number Trace by Occuscreen. You can check your customer’s SSN to know where and when the ID was issued. The result will include all usernames and addresses linked to the SSN.

Furthermore, you can expect your result within 24 hours. In addition, you can also track down new hires to get accurate information before receiving them. Keep in mind that these companies are not associated with the Internal Revenue Service, Department of Homeland Security, Social Security Administration, or any other branch of the government, and their results may not be official.

3. Check with the SSA

Another cool way to verify your SSN is to register with the Social Security Administration (SSA). Then, on the site, sign up for SSNVS, granting you access to verify up to 10 employees’ names and SSNs. This method provides immediate results, making it easy and faster to use.

However, employers ruling many hires can also check up to 250,000 names and SSNs. You can do this by providing a list of the employees with their names and uploading it on the website. Then, you can check your account the next day for your result. However, this service is limited to current or former workers, and the law prohibits employers from using this service for new hires. In addition, the tool is only handy where there is an employer-employee relationship.

4. Consent-Based Social Security Number Verification (CBSV) Service

CBSV is a fee-based Social Security Number verification service for private businesses and government agencies. However, these companies must have authorized and signed consent from the SSN holder. The employer must submit the consent form before the request is granted.

The service provides results for many employees, and the tool is easy to use. The website is robust with safeguarding precautions to prevent the information from reaching third parties. In addition, it provides a secure SSN verification service to the business community.

Furthermore, they provide cost and workload management benefits. Keep in mind that an interested party is required to pay an enrollment fee of $5,000, which is not refundable. However, the organization intends to calculate and adjust the fees periodically. In addition, existing customers are also informed to cancel or continue using the service with the new enrollment fee.

5. Using myE-Verify

myE-Verify is the official page where you can create and log into the USCIS using myAccount. The portal grants you access to USCIS external systems. However, if you lack a USCIS myAccount, you need to create one by providing answers for identity authentication.

The process is explained below:

- Login to myE-Verify.

- Click on the self-check or verify with self-check.

- You can edit your information or click confirm.

- Select citizenship or immigration status.

- Choose the type of document you want to upload based on the selected option in step 4 above.

- Ensure your SSN is correct by using the last four digits.

- After verification, click on submit.

The system will provide an Employment Authorized result or further steps to resolve any misleading information.

The self-check will use the information to check with government records available at the US Department of Homeland Security office.

Conclusion

These are a few ways you can verify your Social Security Number. The verification ensures the new employee is a US citizen or permanent resident. In addition, it protects you from receiving fake SSNs belonging to others or deceased persons. Some people have forged and used these numbers for years without detection.