For an entrepreneur, concentrating on the big reality is a significant priority. The management of customer demands and revenue generation frequently take precedence over business administration. And scammers rely on that very thing and take advantage of your diversion. Also, fraudsters need a short time to locate weak points inside a business. Owners must maintain administrative measures to keep their bottom lines safe.

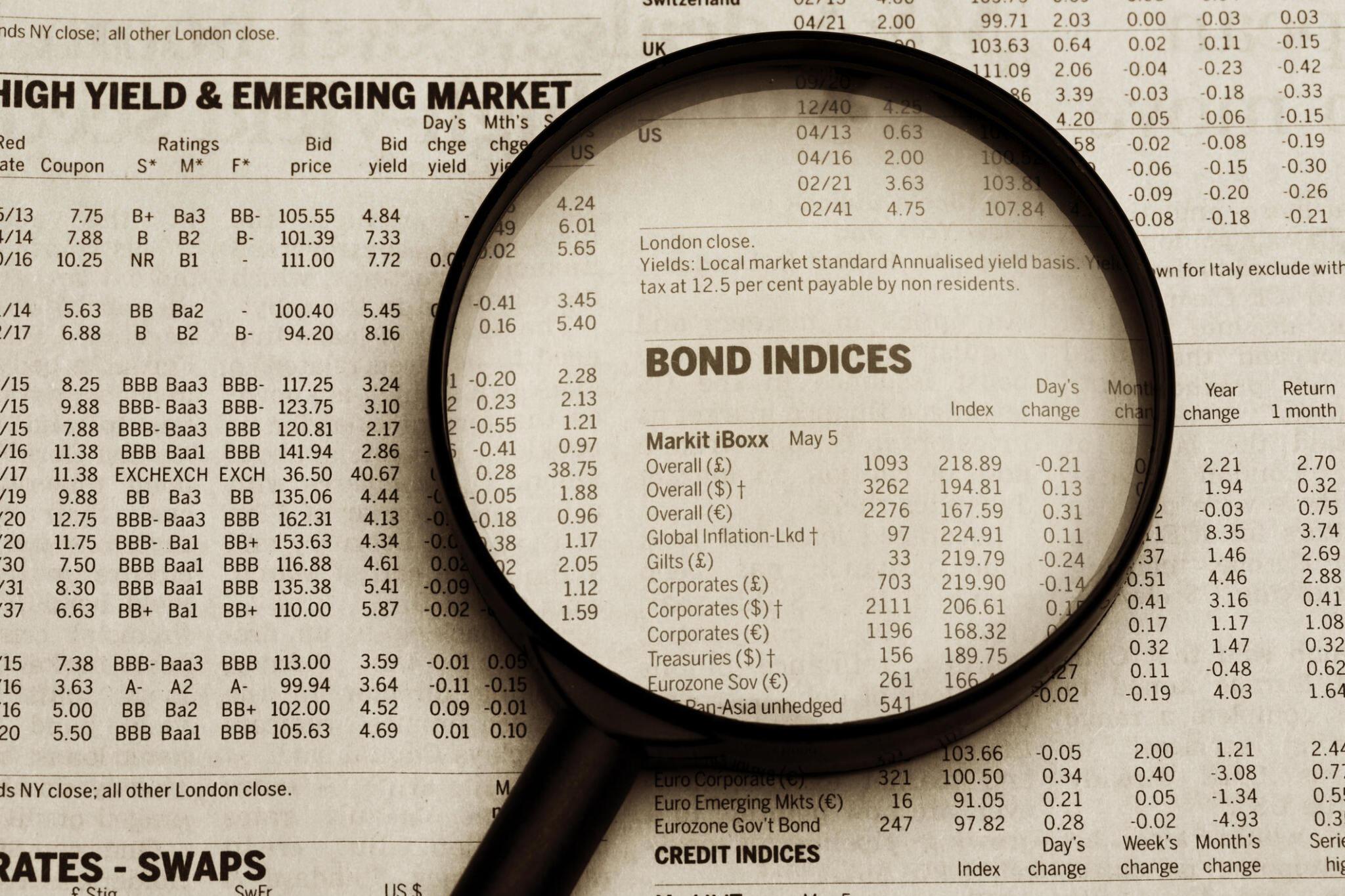

Understand the many forms of payment fraud and how they might damage your bottom line, whether you own or run a business. Any unlawful behavior involving unauthorized use of another person’s or organization’s payment information, such as bank account information, credit card numbers, or Social Security numbers, to make a purchase or withdraw money refers to payment fraud.

The Association of Certified Fraud Examiners opines that occupational fraud has resulted in losses of more than $7 billion, with a median loss of $130,000 per incidence. Small firms and recent startups are most at risk, but large enterprises aren’t exempt. You can easily deploy business fraud protection techniques to thwart internal and external theft.

So, here are seven ways by which you can prevent payment fraud in your company.

1. Be Aware of Traditional Payment Frauds

The rise of new scam techniques does not imply that the older ones no longer exist. Few people tend to use proven methods to steal from the bank. So, suppose you haven’t taken the preventive measures already. In that case, it’s high time you start implementing the fraud protection techniques for forged and fraudulent documents, empty-envelope deposit scams, forged checks, wire transfer fraud, fraudulent loan applications, etc.

Wire transfer fraud is rising, even though it is not new. The American Land Title Association states that in a third of all mortgage and real estate transactions, “Title insurance professionals said hackers attempted to convince workers to wire payments to a bogus account.” Most of these fraud efforts were unsuccessful due to training and knowledge.

You may prevent wire transfer fraud by teaching your staff to validate the legitimacy of wire requests and undergo proper authentication. One method to confirm that the account owner requested the wire transfer is to call the number provided on the account. It’s incredibly crucial to employ many methods of verification for significant sums.

2. Report Missing Checks Immediately

You can discover missing checks when you go over your financial records. If you don’t disclose the missing checks correctly, your company could not be covered by your banking institution’s fraud protection. You often only have a short window to identify the mistake and notify the bank if repeated fraudulent checks successfully clear your bank account. Reverse Positive Pay and other fraud-prevention tools can protect your accounts from fraudulent check activity. Companies that write many checks to protect accounts should consider advanced solutions like Check Positive Pay. Additionally, you can incorporate ACH positive pay to track online transactions.

3. Use a Dedicated Computer for Banking

It would be better to start utilizing a separate computer for financial purposes immediately if your company doesn’t already. Perform banking activities on this computer without email checking, internet browsing, video calls, etc.

Assure that the equipment in issue is hardened and ask your IT staff to limit banking computer network access to only those systems that are necessary for functioning. This would entail turning off unneeded services, limiting privileged access, routinely updating passwords, etc. You can also consider utilizing a system other than Windows as the banking PC as an added safety measure.

4. Build a Profile of Potential Frauds

Use a top-down approach to your risk assessment by outlining the regions of your company where fraud is most likely to happen and the sorts of fraud that may occur there. The risk should then be qualified depending on the organization’s entire exposure. Concentrate on the risks that have the most significant potential to decrease shareholder value, such as those that influence the extended supply chain, such as safety, quality, and supplier and process reliability.

Create fraud risk profiles with the essential decision makers and stakeholders as part of a general risk assessment. By doing this alone, you are unlikely to win the friendship of anyone within the company. For instance, involve the p-card manager in conversations if you believe there is fraud with purchasing cards. Thus, it will be a collaborative endeavor that will benefit both parties and, ideally, lead to a more thorough response to fraud concerns in that sector.

5. Alert Customers When There Is Suspicious Activity

You can involve the customers in fraud prevention techniques by making them aware of unusual activity in their accounts. Ask them to alert you automatically whenever they come across suspicious activity. For instance, if they find that their credit card is being charged from an unknown location far from theirs. Since electronic fraud has become so prevalent, you might alert the customers each time their cards are charged.

6. Don’t Share Personal Information With Anyone

Never divulge personal information, whether online or offline, unless you are certain of the representative’s legitimacy. Any third party or potential fraudster disguising themselves as an executive from a bank or other financial institution is possible. Always check the identification of anyone requesting your financial information. On calls, bank representatives never request critical information such as an OTP or CVV. You shouldn’t share crucial financial information on social media, such as your bank’s name, branch, account number, etc.

7. Fraud Risk Assessment

Banks should carry out a fraud risk assessment every year or every two years, just like going to the doctor for a checkup. The bank is changing, and those developments bring new hazards. An ongoing review of the institution’s fraud risks can help leaders focus their efforts, comprehend these developments, and adjust to them. Someone who regularly examines difficulties with fraud should do this examination.

Summary

Fraud is a significant corporate risk that needs proper handling. A well-designed and executed fraud detection system based on analyzing transactional data from operational systems may reduce the likelihood of fraud occurring inside an organization. The higher the probability of recovering the losses and finding a remedy for control gaps, the sooner fraud signs become accessible. So, the question is how soon you can implement the comprehensive fraud detection and prevention program in light of the growing regulatory requirements and compliance expectations and stop payment fraud.