Thanks to developments in digital payments technology and the changing cyber-security landscape, online transactions are more common and safe than ever.

However, this does not imply that online credit card fraud is not prevalent. Even though eCommerce security and payment systems can guard against fraud and security threats, online card users still risk compromising their security.

Payments made online are “card not present” transactions. As such, online credit card fraud is more likely in this type of financial transaction. Fraudsters can use stolen credit card information and other personal information to purchase without the cardholder’s knowledge.

This report highlights practical ways to improve your online credit card security:

1. Use Your Card on Reputable Online Platforms

Sensitive information shared when you use our credit cards online puts you at risk for identity fraud and other online crimes. Utilize your payment card only on reliable websites. For example, some retail banking services use a payment Hardware Security Module (HSM) service to ensure secure digital payments in the cloud.

Another way to stay safe online is to avoid storing your online credit card information online. You may want to save your credit card information for a more personalized shopping experience on your favorite websites. But doing so increases your vulnerability to identity theft. It’s safe to enter your credit card information every time you purchase, no matter how time-consuming.

Ensure your connection to the website is safe before you use your online credit card to purchase online. Instead of http://, the website URL should begin with https://– a sign that the exchange is secure and encrypted.

In addition, use antivirus/security software to protect your computer. Ensure your computer and other mobile devices have the most up-to-date and reputable antivirus and antispyware software to keep hackers and identity thieves at bay.

2. Replace Your Card If There’s a Breach

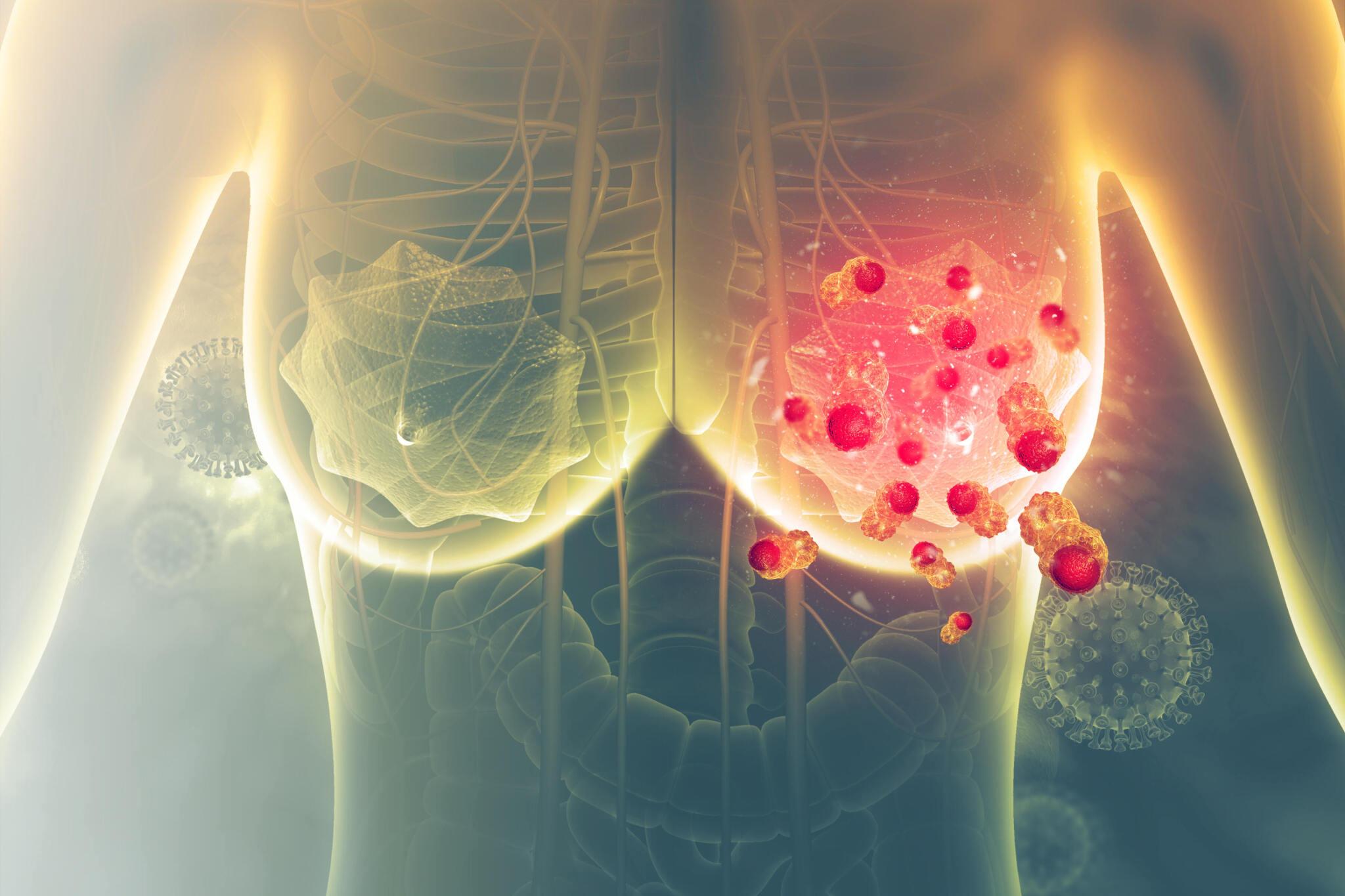

Personal data breaches occur when this information is misplaced, stolen, or inappropriately accessed. Examples include Social Security, bank accounts, and credit card numbers. This information can be used by criminals to steal identities, placing you at risk of accruing debt, damaging your credit, or losing money.

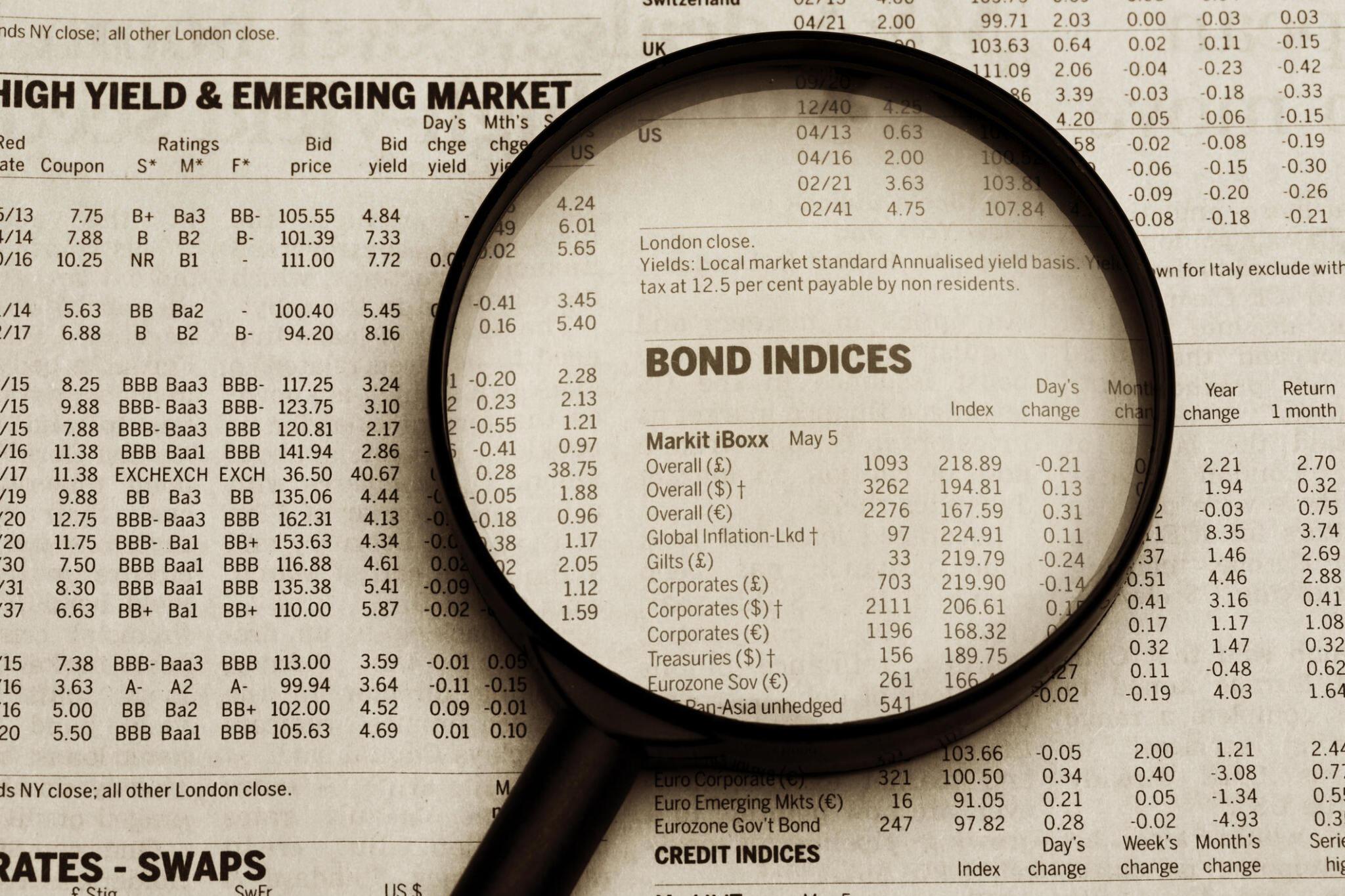

Thousands of people have been victims of recent security breaches, so you should take precautions to safeguard your data. Over 4,100 data breaches occurred in 2022, exposing about 22 billion records.

Inform the credit card company immediately that you require a new card to protect yourself if you discover you’re a data breach victim.

3. Review Statements and Transaction History Regularly

It is best to be on the lookout for fraud and to frequently check your credit accounts to make sure there hasn’t been any activity you aren’t familiar with. Check your credit card statements frequently to make sure the charges were made by the intended user, in this instance, you.

While most credit card companies won’t hold you liable for fraudulent charges, you’ll still need to monitor your spending patterns to spot payments you didn’t authorize. You should check your credit card activity every three to four days to ensure there aren’t strange charges. If you find that too frequently, examining your accounts at least twice a month or billing cycle is advisable.

The Fair Credit Billing Act states you have 60 days to notify your card issuer of fraudulent charges. If you discover the charges after this period, your issuer may no longer be able to cancel them, leaving you responsible for the expenditures. If you wait any longer, you risk running out of time for the provider to make things right.

4. Get Virtual Credit Cards

Virtual credit cards are real credit cards that operate entirely online. These virtual credit and debit cards function similarly to traditional credit cards, complete with a card verification number and expiry date, but without needing a physical card.

Virtual cards increase the security of your online transactions. A virtual card, on the other hand, does not have the same security constraints as a physical card. Virtual cards can generate a unique number for each transaction, safeguarding your real account number. So even if a data breach and your card number gets exposed, your real account would be unaffected.

Virtual cards offer significantly more flexibility. You can generate new card numbers for various stores, change your card number on the fly, and set spending limits. You can even lock or delete a card number without affecting your account. Virtual cards are now available from most card issuers and accepted by any online merchant that accepts credit card payments.

5. Protect Your Credit Card Information

Your credit or debit card’s expiry date, number, and full name are on the card. Most people will recognize your name, but you should keep all other information private from the card. It’s there for you, not for anyone else. These details are required to complete online transactions. This information constitutes the first level of security. A fraudster can only misuse your card if they have access to it. Keep these details private, and don’t reveal them to anyone.

Only give out your credit card number over the phone if you initiated the call. No matter how legitimate the call appears, verify who the caller is and, if necessary, hang up and call the organization back to confirm that they did indeed call you.

6. Use Strong Passwords

Creating strong passwords for your online accounts aids in the protection of your data from cyber-attacks or data theft. Shorter passwords are easier to crack and can be brute-forced by hackers. This type of cyber attack is an illegal attempt to guess a website or service password using several repetitive trial-and-error attempts. This hacking attempt is harder to crack using a password with at least 14 letters.

If 14-character passwords with at least one upper case letter, one lower case letter, a number, and a unique character seem daunting, consider using a passphrase instead. Passwords are often easier to remember than random variations of the required symbols.

Finally, keep your password in a secure location where you can access it but no one else can. It’s best to use a password manager, a service that generates and stores passwords for all your accounts in one place.

In Conclusion

If you haven’t been a victim of online credit card fraud, take proactive steps to reduce your vulnerability. Don’t be alarmed if you have. Call your credit card company, inform them of any incorrect payments, and wait for them to rectify your account. Meanwhile, monitor your credit report and credit card bills for any further indications of unauthorized activity. Most importantly, only use your card on secured payment platforms and use virtual cards when possible.

I just started reading this amazing website, they produce high quality content for people. The site owner works hard to engage customers. I’m delighted and hope they keep up the good work!