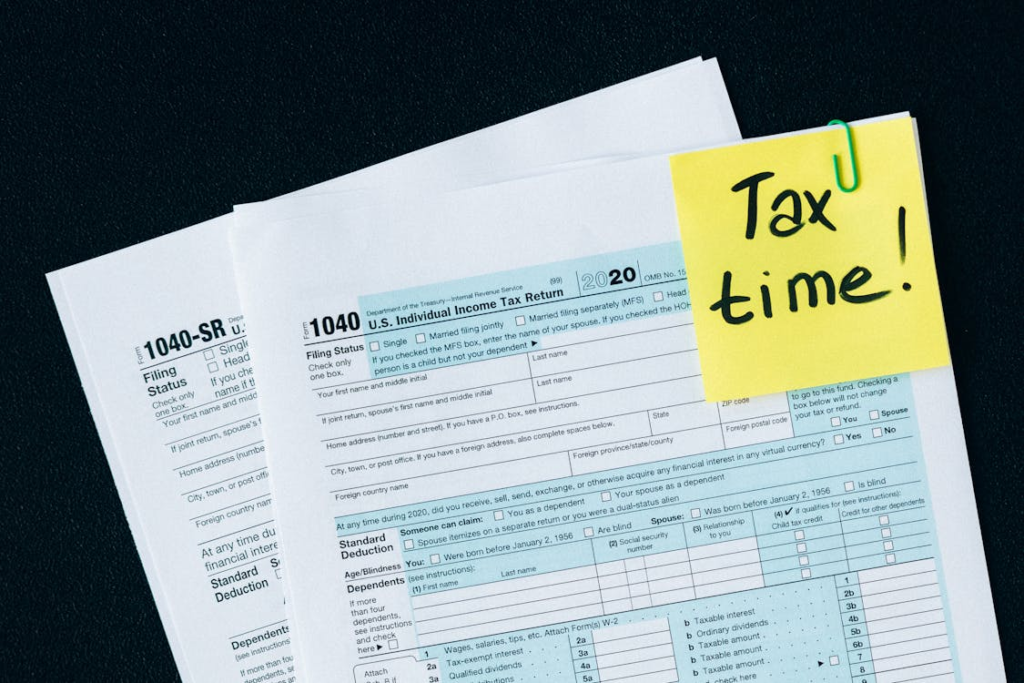

As we are coming to the end of the year, we are approaching the tax season. It can be intimidating and complex to manage taxes for any business, large or small. It’s vital to understand the different taxes you may be obligated to pay and the regulations and requirements you must meet to remain compliant.

For a business, you may need to pay more taxes depending on how much revenue and employees you have. Sometimes, this may make you have a considerable amount of tax that should not have been there in the first place if you were extra cautious.

Fortunately, there are a few effective ways to manage taxes for your business, which can help ensure that you remain compliant and reduce your tax burden.

1. Hire a Professional to Manage Taxes

It’s essential to have a knowledgeable professional to manage taxes because they are familiar with the different tax laws and regulations that apply to the Federal and state levels. Furthermore, hiring a tax professional can help you save time and money by ensuring you are filing accurate and timely returns to prevent any costly penalties or interest.

A professional will also help you identify deductions and credits that can reduce the taxes you owe. You can research the different experts available in the market, where they have different levels of personnel with their prices to help make your decision process easier.

2. Keep your files organized

It’s essential to keep accurate and organized records of all your business income and expenses; this will simplify filing and manage taxes and help you avoid any potential issues with the IRS. Additionally, having accurate and organized records will help you identify deductions and credits that you may be eligible to apply.

You can have a separate cabinet for all your files to prevent you from mixing up the documents with others if you prefer having hard copies. Notably, you should have a backup for all your tax documents in a safe place like your computer or a store at home for an emergency.

3. Track Your Deadlines

It’s essential to know all the deadlines for filing and paying taxes. By failing to file or pay your business taxes on time, you can get a costly penalty and interest. Keep track of all the deadlines for filing and paying federal and state taxes. It would help if you set reminders on your phone to keep you updated on the deadline and how close it is.

Also, if you forget to file your taxes, you can ask for an extension from the state and ensure you pay the fine that will be dictated to avoid landing into more legal problems.

4. Take Advantage of Tax Credits

There are numerous tax credits available to businesses, which can help reduce the amount of taxes you owe. Some of these credits include the research and development tax credit, the energy tax credit, and the Work Opportunity Tax Credit.

For new business owners, it is difficult to know which credits apply to them; hence they should speak with a tax professional to help them know the eligibility criteria. Also, they can guide them on things to avoid that will limit them from getting the credit.

5. Utilize Different Tax Software

Tax software can be a great tool to help you manage taxes for your business. They are simple and easy to use, which makes them easier for beginners. This software can help you track deductions, complete and file your returns, and stay updated on the latest tax laws and regulations. It can also help you identify potential deductions and credits you may be eligible for.

The software is not expensive, and you may need to update them annually so that they have the right information. You can search for the different types of tax software and their features on the internet to ensure you are using the right one.

6. Stay Up to Date on Tax Laws

Tax laws and regulations are constantly changing, and it’s important to remain current. Stay informed on the latest tax laws and regulations that may affect your business; this will help you ensure that you comply and help reduce the amount of taxes you owe.

You can learn about some of the different types of state and federal taxes since they differ. The state tax applies to business licenses and rent. In contrast, the federal tax affects the employee’s salary and profits.

Conclusion

Managing taxes for your business can be a daunting and complex process. But by following these effective tips, you can ensure that you remain compliant and reduce your tax burden. Hiring a professional, staying organized, keeping track of deadlines, utilizing tax software, and staying up to date on tax laws can help you manage taxes for your business and save time and money.

It will help if you continue researching other tips that will help you reduce the taxes you pay annually. By reducing the taxes, you can increase your profit, which will help expand your business. You can also indulge your family in your business to reduce your spending on paying employees.