Recent developments in data have made it a game-changer for commercial real estate firms.

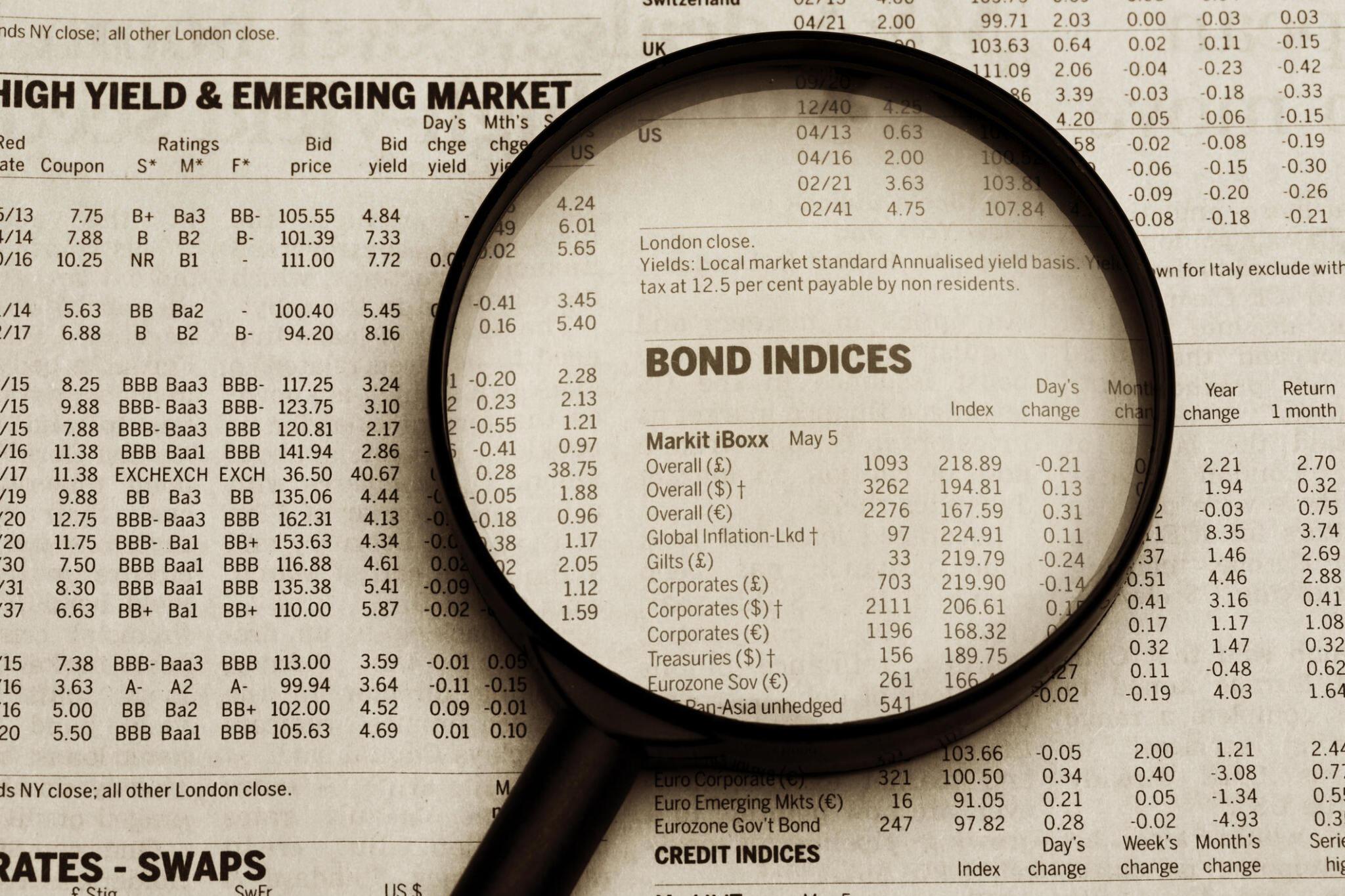

Many have started relying on location and first-party data to conduct advanced market analysis and investment research before making major business decisions.

This has allowed many commercial property companies to reduce the risks associated with their investments and create a more ROI-positive investment strategy. And with the world still recovering from a difficult pandemic year, there is momentum for investing in high-value and attractively-priced real estate opportunities.

Access to the right data is key to understanding which opportunities in commercial real estate are most promising in the post-pandemic era. Moreover, these insights can be used by commercial real estate companies to improve their portfolio management strategies and influence future tenants’ leasing decisions.

However, in tandem with all of these changes, it’s also important to realize that many of these decisions can have long-term financial consequences.

1. Commercial Real Estate Companies Have An Edge With Data

Commercial real estate companies often need help narrowing down investment opportunities, especially now that so many vacant properties are available.

Therefore, data of any caliber can greatly help get a targeted search started. This makes it easier to find properties that match your investment goals or meet certain search criteria.

Here are a few areas where data has made an impact on commercial real estate:

- Cost Reduction:

The right data can help to reduce the time it takes from the beginning of a property search to filling a vacant space. Thus, this can lead to greater operational efficiencies, resulting in substantial time and cost savings.

- Strategy Development:

Access to any data alone is unlikely to make a difference.

You need correct and precise data to build solid strategies and make better investment decisions. If the data you work with does not meet those standards, it could lead to poor investment decisions that can have serious financial consequences.

- Tenant Satisfaction:

Engaging in leasing conversations with potential tenants is easier when you have the right insights to close deals quickly.

Understanding your properties better will help you build more compelling cases. This is a great way to increase the value of your entire commercial property.

2. What Kind of Analysis Can be Done with Location Data?

Location data can do a lot in the commercial real estate world. These are some of the most popular uses that you should keep in mind:

- Market Analysis

Market analysis should be standard practice for every commercial realty company.

This is to determine if a particular business location, zoned for specific types of business, will be successful. Thus, if it is, it will command a higher rent value. It is also a great way to reduce potential risks before investing too heavily.

Several factors, location, supply and demand, ROI (return on investment) potential, and pricing considerations are crucial for commercial property data. These factors are crucial in determining the property’s ultimate rentability and should be considered by businesses before making investment decisions.

If a property is not subject to thorough market analysis, it could be left unoccupied and collecting dust for many months.

- Site Selection And Portfolio Management

Location data can be used in many ways to support portfolio management and site selection for commercial real estate. It all comes down to which property types are being considered for purchase.

In retail site selection, location data can be used to pinpoint the spots that will bring the most success for businesses looking to lease those properties.

It’s all about planning ahead. The return on investment from a retail site is only when a tenant succeeds. So, commercial real estate companies must be able to paint a picture of what success looks like for tenants to fill vacant spaces quickly.

When commercial real estate firms invest in office space, they sometimes pay more attention to the property’s proximity and accessibility to cafes, restaurants, and hotels. This is because commercial real estate companies can price convenience as a perk in developing lease packages by considering the property’s surroundings.

- Risk Mitigation

Layering location data with other non-traditional sources of data to create traditional commercial realty data can help increase clarity about a property’s nuances.

For example, even though two buildings that appear identical when compared using traditional metrics can experience very different growth paths. This is how a portfolio can achieve dramatic results when it has a variety of investments. It’s easy to see how the disparity at each building level can lead to significant growth.

Adding location-based data to existing data sources on market performance, property features, and property performance can give investors new and improved ways to assess a property’s long-term potential. These insights can provide valuable context to help you make sound decisions and reduce risk.

3. Better Real Estate Decision-Making Starts with Location Data

The commercial real estate market is changing for the better because of location data. It not only adds new types of value to traditional real estate data sources, including information about market performance and property values, but it also pinpoints the details that make a property a better investment.