Investing in the stock market is commonly perceived as dangerous and complicated. And while this is partially accurate, purchasing and selling shares is one of the most effective wealth-building tactics accessible, even for those with limited beginning capital. Every share represents a portion of the underlying company. Consequently, shareholders are entitled to a part of the earnings. You can accumulate long-term wealth just through stock ownership. And in this article, we will explain precisely how to do so. Keep reading

1. Choose a stock broker online

An online stock broker is the most convenient method for buying shares. After registering and funding your account, you can make investments within minutes using the broker’s website. Additional choices include utilizing a full-service stockbroker or purchasing shares directly from the corporation. Opening a brokerage account online is as simple as opening a bank account: You finish an account application, submit evidence of identification, and decide between mailing a check and transferring funds electronically to fund the account.

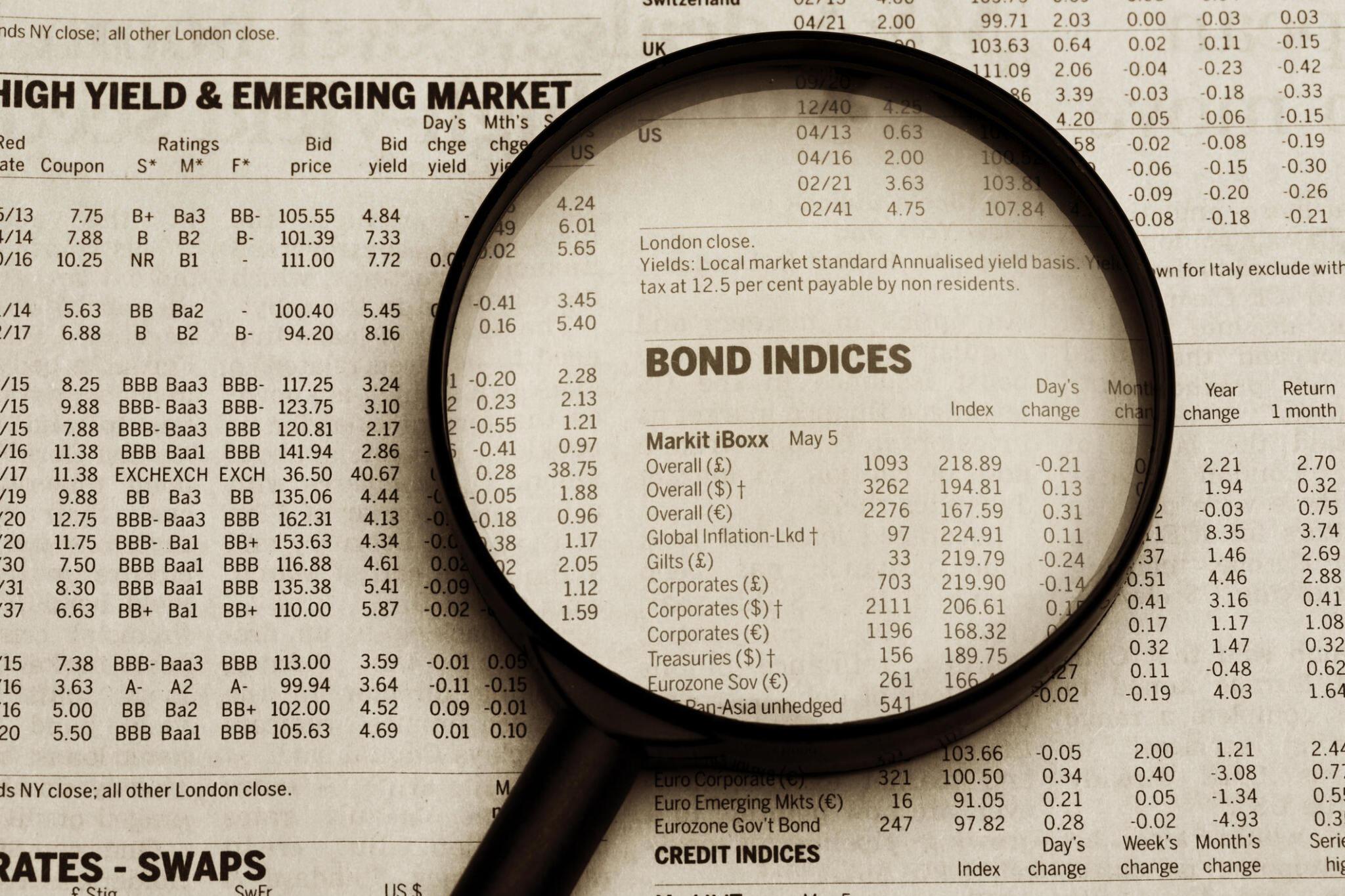

2. Evaluate the stocks you intend to purchase

After creating and funding your trading account, it is time to select stocks. Begin by investigating businesses you are already familiar with from your consumer experiences. As you conduct extensive research, don’t let the flood of information and current market fluctuations intimidate you. Keep the purpose straightforward: you’re seeking businesses in which to invest. Invest in a corporation because you desire to own it, not because you want the stock price to rise. Warren Buffet has done quite well for himself by adhering to this rule.

After identifying these businesses, you should conduct some study. Start with the company’s annual report, particularly the annual letter from management to shareholders. The statement will offer an overview of the current company situation and provide context for the data in the report. After then, the majority of the data and analysis instruments you need to assess the business, like SEC filings, conference call transcripts, quarterly earnings reports, and recent news, will be accessible on your broker’s website. Most online brokers also offer instructions on how to utilize their tools and basic tutorials on choosing equities.

3. Determine the number of shares to acquire

It would be best not to feel compelled to purchase a specific quantity of shares or to fill your investment portfolio with a single stock. Consider getting your feet wet with paper trading utilizing a stock market simulator. You can practice buying and selling stocks with play money through paper trading. Or, if you are prepared to invest actual cash, you can start small – very modest. You may purchase a single share to get a feel for what it’s like to own individual stocks and determine if you have the courage to weather the tough periods with minimum sleep loss. You can increase your position as you gain shareholder confidence over time.

Fractional shares are a relatively new offering from online brokers that enable investors to purchase a piece of a stock rather than the entire share. It means you can invest in expensive equities with a much lower sum. Many brokerages also provide a tool for converting dollars to shares. It can be useful if you wish to invest a specific sum, such as $500, and want to know how many shares that money could purchase.

4. Select an order type

There are various order types for stocks purchases. The type of buy order you place indicates the terms under which you want your broker to execute the transaction. The ideal order type for buy-and-hold investors is often a market order, which advises the broker to purchase the stocks immediately at the best price.

Alternatively, you may wish to issue a “limit order,” which specifies to your broker the maximum price you are willing to pay for a stock. For instance, if a company is now trading at $50.50 per share and you only want to purchase it if the price falls below $50, you would place a limit order. Your broker would only engage on your behalf if the stock price fell below $50.

5. Make an order for the stock with your broker

Access the appropriate part of your brokerage’s platform and provide the information needed to place a stock order. Your brokerage will normally request the company or stock ticker, the dollar amount or the number of shares you desire, and whether you wish to purchase or sell shares.

After clicking the “place order” button, your stock purchase should be processed within a few seconds. Your portfolio should be quickly updated to reflect your newly acquired shares.

6. Create a Portfolio

Developing your investment portfolio is the final step of this procedure. After knowing about brokerage account, you must understand the fundamentals of buying and selling stocks, you can continue adding money to your brokerage account and investing in equities you would like to own for many years.

Even though it can be tempting to examine your stocks’ performance daily (especially initially), it is essential to retain a long-term perspective. Certainly, you can and should read quarterly reports and subscribe to news alerts to stay up-to-date on any company in which you own stock. But if the price of your equities declines somewhat, you should not sell quickly. And if the price of your equities rises by a few dollars, resist the impulse to sell. The smartest and simplest approach to accumulate money over time is to purchase shares of great firms and hold on to them for as long as those companies remain strong.

7. Evaluate your Stock Holdings Continuously

You have successfully purchased the shares, and they are now yours. Now, monitoring your money is crucial. If you bought the shares intending to hold them long-term, you do not need to monitor daily price fluctuations. However, you can review quarterly or annual reports and business guidance. It entails periodically re-evaluating your investment plan. For short-term buyers, position management may involve establishing a stop-loss price to limit losses and a target price at which to sell stocks for a profit.

Final Thoughts

If you have read this far, cheer! You are now an investor. That is all. You are now familiar with the fundamentals of buying shares on the stock market. And you may start assembling a powerful portfolio that generates wealth based on your optimal investment plan. Maintain accurate records of all transactions. If you are not utilizing a tax-efficient account, such as an ISA or SIPP, you should use those documents to file your yearly tax return or self-assessment.

I’ve been visiting this site for years, and it never fails to impress me with its fresh perspectives and wealth of knowledge. The attention to detail and commitment to quality is evident. This is a true asset for anyone seeking to learn and grow.

Точно важные события подиума.

Исчерпывающие новости лучших подуимов.

Модные дома, лейблы, гедонизм.

Интересное место для модных хайпбистов.

https://myfashionacademy.ru/