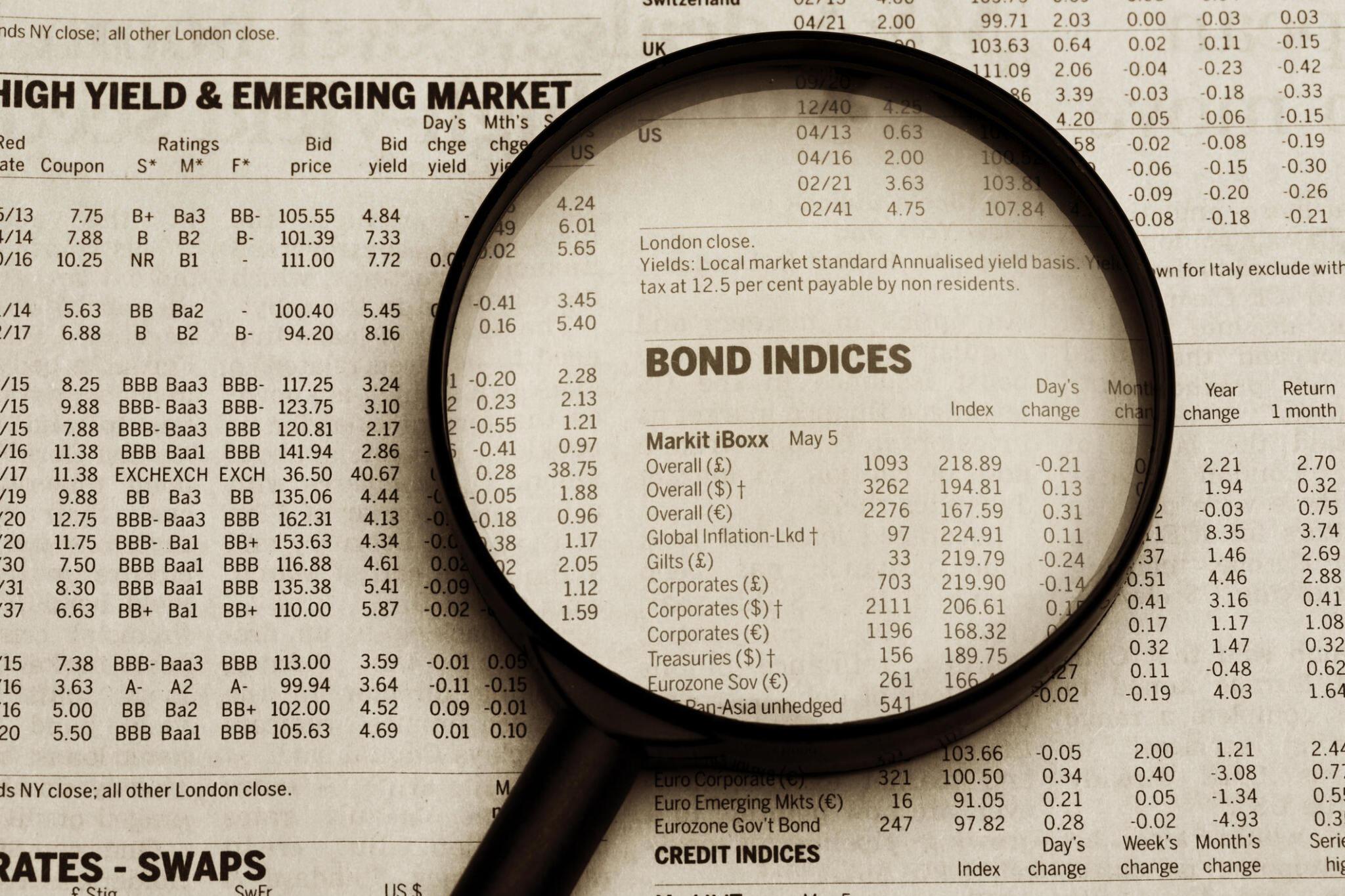

According to industry estimates, FinTech investment peaked in 2021 at $91.5 billion, representing a 20% increase over the previous year’s investment.

More and more smart businesses like using advanced technology to automate their payment processes. But what exactly makes companies want to expand with FinTech solutions?

Fintech Consulting is necessary for any business that wants to stay afloat in the current business environment. There are many benefits associated with business consulting.

They include; quality industry expertise, research and analysis, assistance in regulatory compliance, assessment and management of risks, and provision of flexibility to financial services, as will be discussed below.

1. Offers Quality Industry Expertise

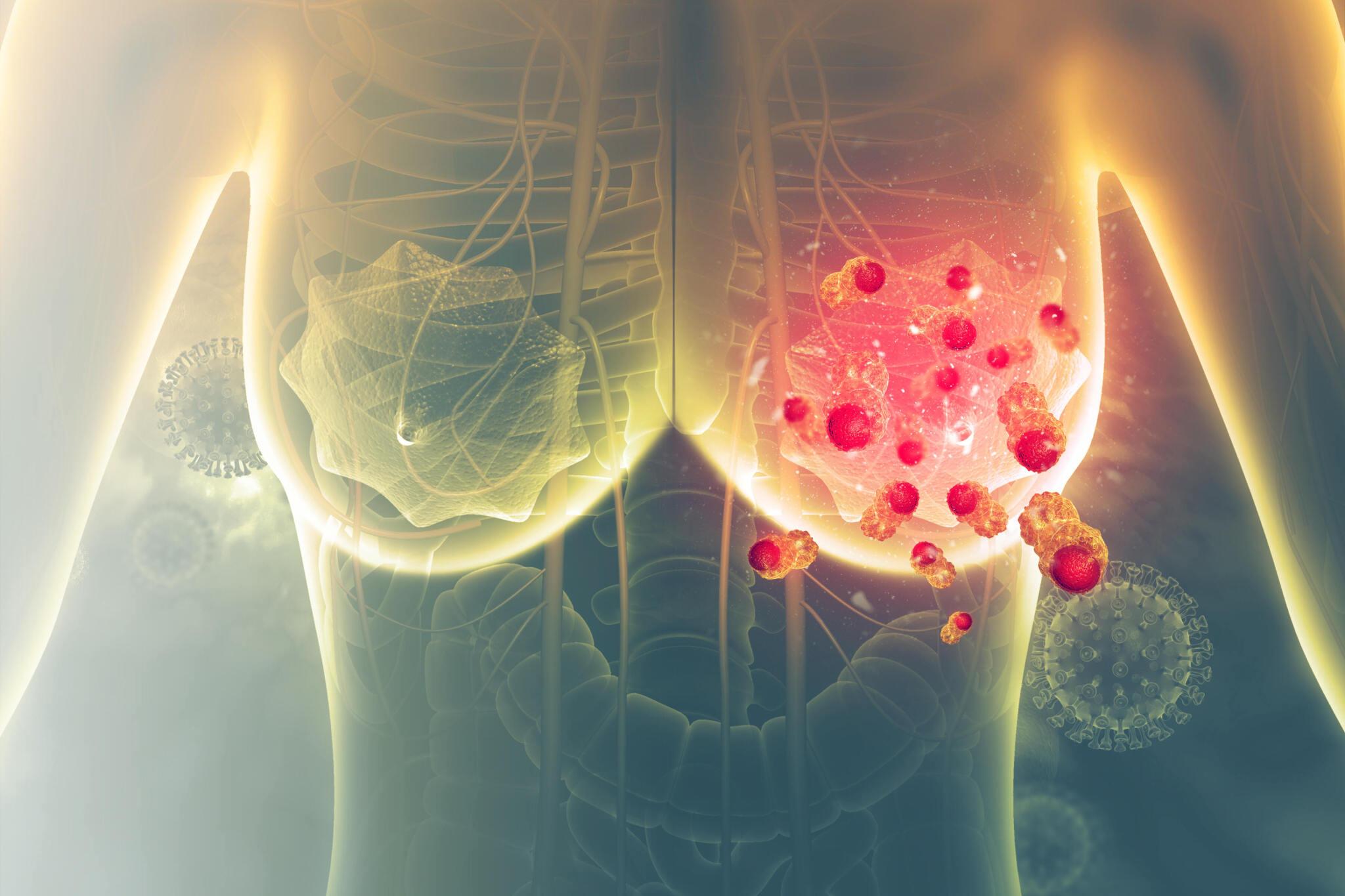

Technology has changed the way different industry fields operate. Technology is at the center of operations from the health sector to government operations and services to public utilities to the financial sector.

A fintech consultant has experience and knowledge in the financial and technology sectors and how the two work together. Fintech consulting provides an opportunity for the industry to enjoy quality expertise.

Fintech consultants possess specialized expertise and in-depth knowledge of the financial technology sector. With these services, you will be in the know of emerging technologies, industry trends, and regulations.

Since they are specialized in that area, most of what they do is research and analysis of emerging technologies and innovations in fintech, market developments, and regulatory changes.

2. Assist in Research and Analysis

Additionally, fintech consultants are essential because they engage in research and analysis.

If you have a financial company or business, you occasionally need to research specific areas to venture into. In that case, fintech consulting is the best place to try it out. The experts in the field invest significant effort and time to conduct research and analysis in different industry segments.

Therefore, you will be sure to enjoy extensive and quality research worth basing your decisions on. From their expertise, you will get a quality report on the major opportunities, emerging themes, and the likely challenges you might face in your business.

3. Help in Regulatory Compliance

It is quite hard to navigate the financial sector without missing some regulatory compliance. If you take on the task of adhering to popular regulations, you may stumble upon regulations that are difficult to interpret or that are new and emerging. In that case, you will most definitely require the services of a fintech consultant. They assist in many critical areas.

First, fintech consultants have extensive regulatory knowledge. Since fintech is their area of expertise, they have gathered reliable expertise and experience in the financial sector’s regulatory frameworks. Moreover, they are up to date with the latest guidelines, regulations, and compliance that regulatory bodies like banks impose.

In addition to having extensive regulatory knowledge, fintech experts can also be very helpful with compliance. Conducting a compliance assessment of all the sectors of your business is always a good practice.

A fintech consultant will do a great job guiding you through your business’s compliance evaluation. They will review the procedures, policies, data management practices, documentation, and internal controls to provide you with a detailed compliance status.

With their recommendations on corrective measures and actions, you could seal the loopholes and avoid the regulatory bodies’ crackdowns and fines.

4. Are Efficient in Managing and Assessing Risks

Running a business without proper and professional risk assessment is dangerous because the business will fall, victim when uncertainties materialize. Therefore, businesses need the services of fintech consulting firms to mitigate potential risks.

Fintech consultants identify risks by closely working with the business to understand better their operations and, thus, likely risks.

The fintech consultants examine the internal systems, processes, and external factors posing risks. Technology has been resourceful to the financial sector but is also a double-edged sword. On the downside, most businesses have suffered from the ills of cyber-attacks and hacking.

Therefore, Fintech consultants help identify the risks associated with operational vulnerabilities, cybersecurity, technological infrastructure, and data privacy.

Fintech consultants will also help prioritize and quantify your company’s risks. In that case, you will know what to put first regarding risk mitigation measures. In assessing the nature and the likelihood of your business’s risks, fintech consulting provides a better and more efficient way of managing risks.

The good thing is that fintech constancy services will go ahead to provide or suggest strategies to mitigate risks. They collaborate with businesses to formulate effective strategies for risk mitigation.

Most businesses need to learn what to do with the risk assessment information. Instead of fumbling with their little knowledge of how to counter the emerging risks, they could work with the fintech consultancy to formulate strategies for risk mitigation. Fintech consultants will assist in guiding implementation processes, controls, and procedures for eliminating the risks identified.

5. Provide Flexibility to Financial Activities

The ability to facilitate flexibility in financial activities is the next benefit of fintech for contemporary society. Full financial transactions were formerly conducted offline, but they are now fully possible online. That entails that people can conduct financial transactions without limitations from any location at any time, giving every community the freedom to conduct specific financial transactions.

These are the advantages that fintech brings to society. With this explanation of the benefits of using fintech, more people will be aware of these advantages and won’t be hesitant to use fintech if they feel they need it.

6. Provide a Wider Loan Reference for Consumers

Fintech has numerous other advantages for contemporary society, including expanding loan options for consumers, particularly business owners who may want loan money to expand their operations.

Fintech has made it possible to obtain loans in a wider range of ways, each with its benefits and drawbacks. Additionally, business people will profit from reduced interest rates, making it simpler to repay their loans whenever they are due.

7. Assist in Business Processes Optimization

Companies using digital financial services are three times more likely to see revenue growth. By methodically optimizing financial transaction and investment processes, you contribute to the proficiency and expansion of many firms when you own a FinTech product.

Today, implementing new financial technology does not necessitate a large infrastructure overhaul or financial outlay. Businesses can implement a simple payment procedure at a reasonable cost and benefit from the excellent optimization that comes with it.

Final Thought

Fintech consulting is essential for the survival and thriving of any business. Consulting firms provide valuable resources and expertise to the financial technology industry. With the services of the fintech consulting firms, you will have an added advantage over other businesses because of the benefits highlighted above.

Therefore, you must consider investing in fintech consultancy to have a competitive advantage over your industry peers.

Find aged Stripe accounts with a proven transaction history on this platform, ideal for businesses needing secure accounts.