Forex trading is a popular way to generate substantial profits, but it is also a high-risk investment. To succeed in Forex Trading, it is crucial to follow specific rules that have proven effective over time. In this article, we will discuss the 5 golden rules that every Forex trader should follow to increase their chances of success.

From setting clear investment goals to continuously educating yourself, these rules will give you a strong foundation for your Forex Trading journey. Whether you are a seasoned trader or just starting, these rules are essential to follow if you want to see positive results. So buckle up, take notes, and let’s dive into the world of Forex Trading!

#1 Have a clear understanding of your investment goals

The first golden rule of Forex Trading is to start with a clear understanding of your investment goals. This may seem like a no-brainer, but you’d be surprised at how many traders dive into the market without clearly understanding what they hope to achieve. Setting investment goals is crucial to success in Forex Trading, as it provides you with a roadmap to follow and helps you measure your progress.

It’s essential to be realistic and specific when setting your investment goals. For example, instead of saying, “I want to make a lot of money,” try setting a more specific goal like “I want to increase my trading account by 10% in the next 6 months.” Having a clear and measurable goal will give you a sense of direction and allow you to track your progress, making it easier to adjust your trading strategy if needed.

Another important aspect of setting investment goals is ensuring they align with your overall financial goals and risk tolerance. Forex Trading can be volatile, especially if you compare your funds on pound dollar charts. Therefore, it’s essential to understand that there is always the potential for both gains and losses. By clearly understanding your investment goals and risk tolerance, you can ensure that your Forex Trading activities align with your overall financial plan.

#2 Never risk more than you can afford to lose

The second golden rule of Forex Trading is never to risk more than you can afford to lose. This rule is crucial for maintaining a healthy and sustainable trading strategy. Forex Trading involves a certain level of risk, and it’s important to understand that there is always the potential for losses. That’s why it’s important to have a solid risk management plan to minimize potential losses and protect your trading account.

One of the most effective ways to manage risk is never to risk more than a small percentage of your trading account on any trade. This helps to ensure that a single losing trade doesn’t significantly impact your overall trading account and allows you to maintain a long-term perspective.

Another critical risk management aspect is setting stop-loss orders on your trades. Stop-loss orders are automated instructions that close out a trade at a predetermined price, helping to minimize potential losses.

#3 Have a well-defined trading plan and stick to it

A trading plan is like a roadmap that outlines your investment goals, risk management, and trading strategy. Having a trading plan in place is important to provide structure and discipline to your Forex Trading activities.

A well-defined trading plan should include your investment goals, risk management strategy, and a clear outline of your trading strategy. This may include the markets you plan to trade, your preferred time frame, and the indicators and tools you will use to make informed trading decisions. Sticking to your trading plan and avoiding deviating from it based on emotions or short-term market fluctuations is also essential. This can be easier said than done, but maintaining discipline and sticking to your trading plan can help you achieve long-term success in Forex Trading.

#4 Be patient and avoid impulsive decisions

Forex Trading can be a fast-paced and exciting market, but it’s important to remember that success in Forex Trading requires patience and a long-term perspective.

One of the biggest challenges in Forex Trading is avoiding impulsive decisions based on emotions such as fear, greed, and excitement. Impulsive decisions can lead to poor trading decisions and significant losses, which is why it’s essential to maintain a patient and disciplined approach to Forex Trading.

#5 Continuously educate yourself and stay up-to-date with market trends

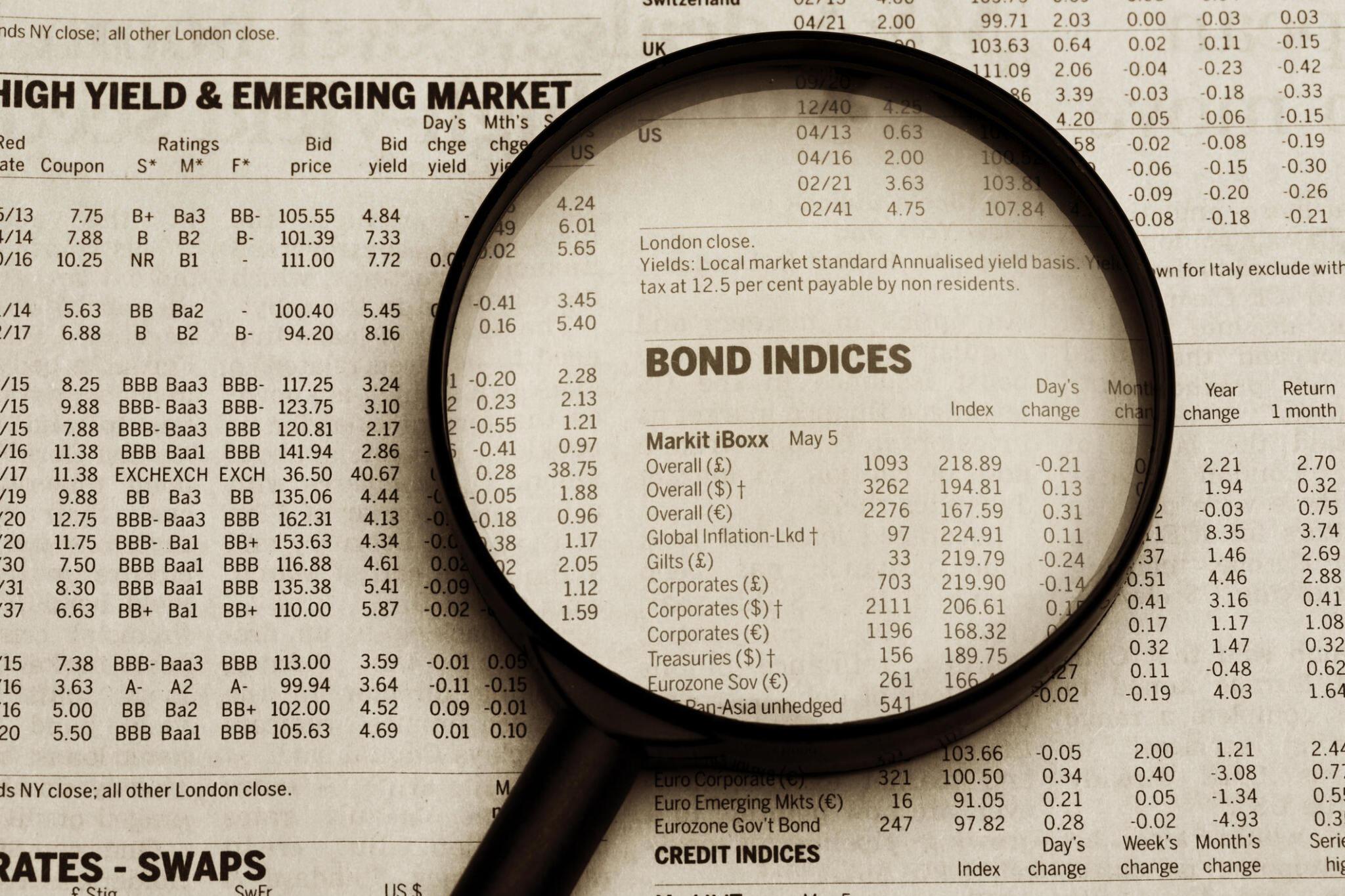

Forex Trading is a dynamic and constantly evolving market, and it’s essential to stay informed about the latest developments and trends. By continuously educating yourself and staying up-to-date with market trends, you can make informed trading decisions and improve your chances of success.

There are many ways to stay informed about the Forex market, including reading market analysis, attending seminars and webinars, and following industry experts on social media. Additionally, keeping a close eye on economic data releases, central bank decisions, and global events can provide valuable insights into market trends and help you make informed trading decisions.

Another important aspect of continuous education is to improve your trading skills continuously. This may involve reading books, taking online courses, or seeking mentorship from experienced traders. By continuously improving your skills, you can stay ahead of the curve and be better equipped to make informed trading decisions.

Final Thoughts

Forex Trading’s success requires discipline, patience, and a well-defined plan. By following the five golden rules outlined in this article, you can increase your chances of success and reach your investment goals in the Forex market. Forex Trading is a journey; success takes time, effort, and a disciplined approach.

3 thoughts on “Forex Trading: 5 Golden Rules to Follow”