From insurance specialist to claims writer to claims representative, a career in life insurance poses numerous job opportunities. With various big-name companies seeking immediate employees in this field, now is the time to start (and grow) your career!

Unsure of what a career in life insurance entails? We have you covered! Read on to discover our five key considerations.

1. A Versatile Career Choice

With so many career paths to consider in life insurance, this vocation is a versatile career choice, to say the least! It’s a profession that you can tailor to your specific skill set. If you’re detail-oriented, a claims clerk may be a good place to start, while if you’re interested in valuations, an insurance appraiser may be more your cup of tea.

All of the roles boast different salaries, different skill sets, and varying opportunities in terms of growth. When asking yourself, ‘Is life insurance a good career path?’ It’s a good idea to do your research before applying for a specific role, considering where your strengths lie and comparing these to the available roles.

2. A Career that Allows You to Make a Difference

An excellent insurance pro has the tools to protect clients and help those in need. Whether a client is suffering a health crisis or has been the victim of a crime or a natural disaster, it’s your job to provide them and their beneficiaries with the best advice possible.

On another note, a career in this self-driven industry is an ideal opportunity to assist humanitarian workers through international insurance coverage. Military personnel, international teachers, non-governmental organizations, and the Foreign Service often take out this type of life insurance coverage.

Why? Most of these people are working in high-risk areas. It’s your job to find bespoke, affordable cover that protects assets and people.

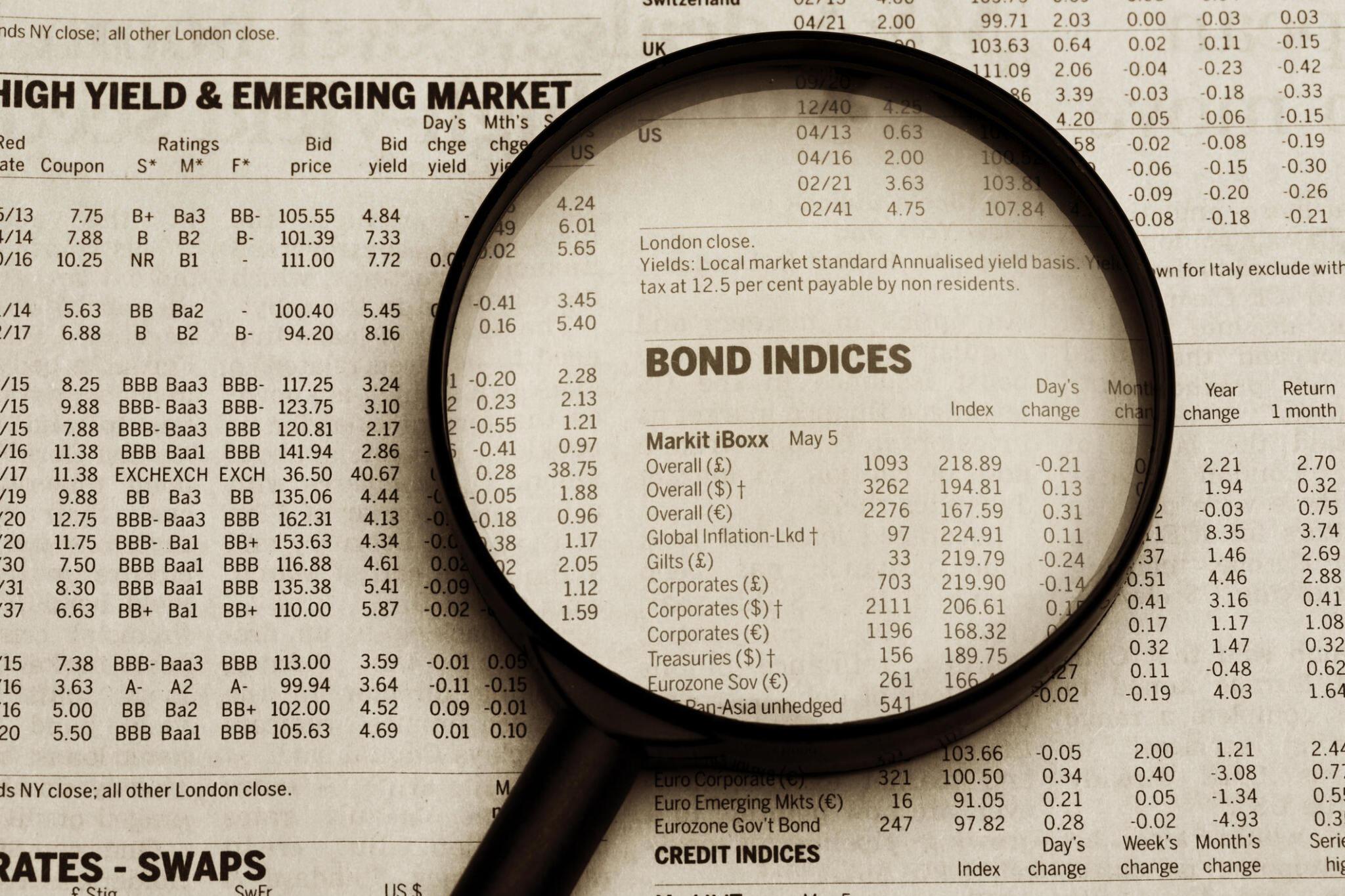

In addition to assisting clients with insurance claims, insurance professionals can assist individuals wishing to invest in a business or climb the property ladder.

In a nutshell, wherever there is value, it is your job to help your clients protect, prolong, and increase their assets.

3. Heightened Job Security

A career in life insurance is a great option for those looking for a role that promises heightened job security. Often nicknamed an ‘evergreen career,’ this is a stable job to enroll in, as it offers superb job security. At present, there are over 94,000 job openings for life insurance agents alone in the US! This figure is only set to rise in the future.

If you’re looking for a role that allows you to rise through the ranks, this maybe it! Many companies even offer opportunities for secondments abroad – another enticing consideration for those looking to travel with work!

4. A Job that is both Rewarding and Engaging

Another big selling point of a vocation in life insurance? It’s engaging! No two days are the same. One day, you’ll be using interpersonal skills; the next, you’ll be using math while combining statistics and critical analysis to assess various situations.

On top of this, it’s a lucrative industry. If you work hard and put the time in, you may find yourself

taking home a six-figure income within just three to five years.

Many companies also offer employees attractive compensation benefits and bonuses, each boasting a different structure. These comprise 100% commission, subsidy plus commission, base plus commission, and base plus bonus for every policy sold. All are an incentive to sell, which makes this line of work incredibly motivating – especially for those driven by sales.

5. There is Plenty of Support Available

Even if you don’t think you have the necessary skills for a life insurance career, many roles offer on-the-job training. From online courses to in-house training to access to a mentor, you’ll receive great support in this line of work. All will add to your CV, development, and, ultimately, your success.

For best results, research the companies before applying for roles, and pick those offering a strong support network, a good leadership core, and an array of educational opportunities.

The Bottom Line

Even if you’ve never considered a career in life insurance, now may be the time to do so! With an array of job opportunities, one is bound to be suited to your skill set. On top of this, the training available makes developing your career a breeze.

Then there are the many benefits to consider, including the ability to help those in need and the chance to take home an impressive salary. Providing you’re willing to work hard and learn on the job, a career in life insurance is most definitely worth pursuing. So, what have you been waiting for? Check the article and integrate some of the pointers.