Are you thinking about setting up a company abroad? If yes, this article is for you. We’ll be discussing five basic requirements to start your journey.

Setting up a company overseas is no longer a daunting task. It has become easier than ever, thanks to the availability of various services. However, it requires a lot of preparation.

There are numerous factors you must consider before starting a business in another country. One of them is to choose the right location and ensure that you meet the host country’s legal requirements.

Choosing the correct country depends on several factors, such as your preferred business, tax structure, etc.

The first step in choosing the right place for your company is identifying its needs. You can do it by asking yourself questions like What are my goals? How much capital will I need? Do I have any experience with international trade?

Once you know what you want, you can narrow down your choices based on the answers to these questions.

Now, let us discuss the five basic requirements for setting up a company abroad:

1. Seek Advice from Professionals

When starting a business abroad, you must know your obligations under federal law. You must file certain forms, pay taxes, and follow other requirements.

But there are many other things to consider, too. For example, consult professionals about how to draft contracts and set up your books.

You don’t have to do everything yourself. There are several companies out there willing to help you navigate the process.

A company like a1corp.com.sg can guide you through the steps required to start a business legally. Their priority is to provide the best customer service. Also, their team is knowledgeable and updated with new information to benefit their clients.

You should also check out the local laws about your chosen destination. This way, you won’t be caught off guard when opening your business doors.

2. Choose a Business Structure

Business structures differ from one country to another. Some countries are great for sole proprietorships, while others allow partnerships or corporations.

If you’re not sure of the type of business structure to use, look at the following options:

- A sole proprietorship: This is one of the simplest forms of business ownership. You’ll be trading under your name, and you’ll be responsible for paying taxes.

- A limited liability partnership: If you’ve got a partner, you could opt for a partnership. This is where both parties contribute equally towards the business.

- An unlimited liability partnership: With this form of business ownership, you’ll be liable for everything that happens within the business.

The choice of a business structure depends on what you intend to do with the business and how much risk you’re willing to take. For example, if you’re planning to run a small mom-and-pop shop, you might choose a sole proprietorship. On the other hand, if you’re looking to expand your operations, you might consider opening a franchise.

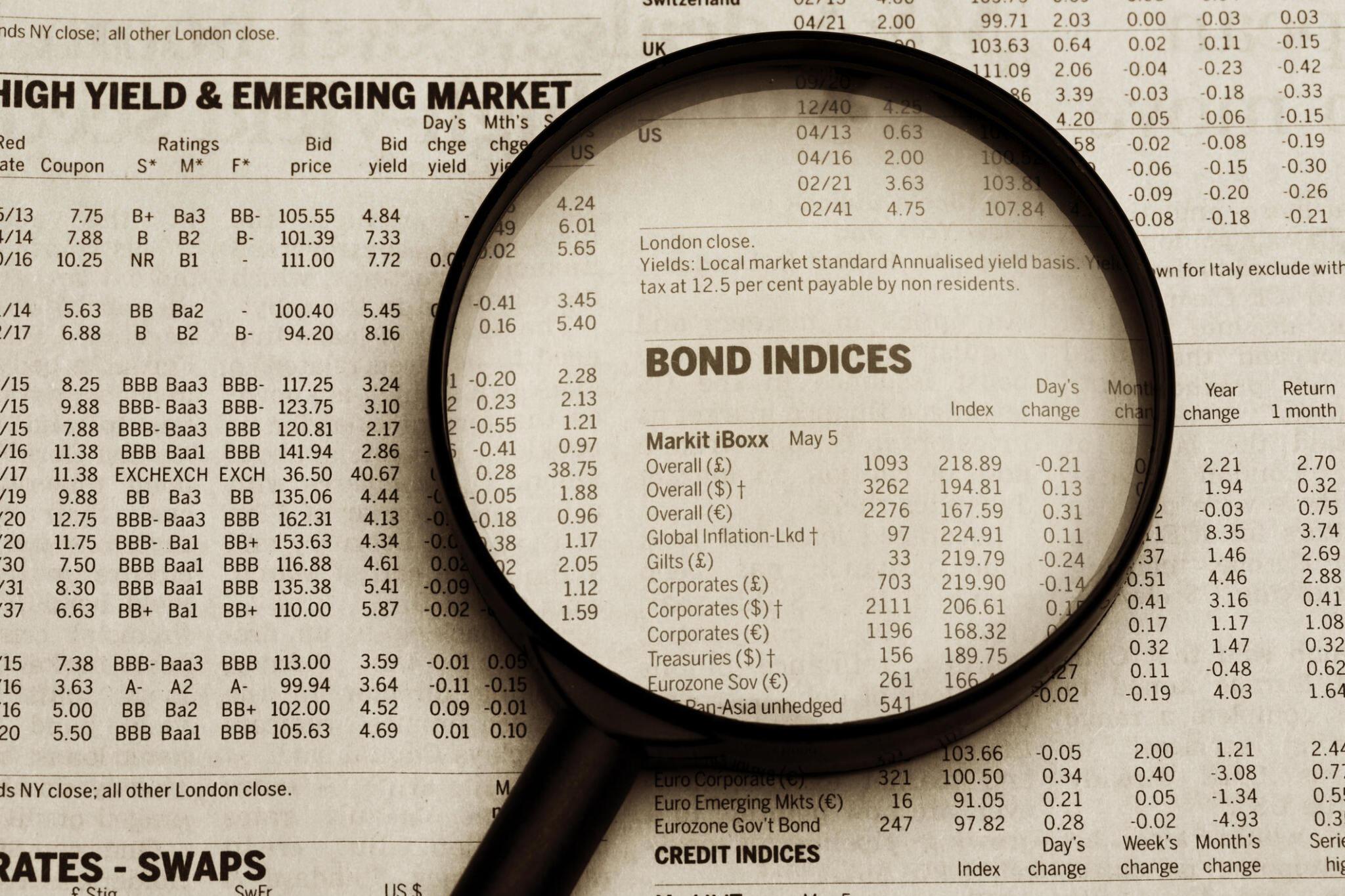

3. Understand Tax Requirements

Taxes play an important role in determining whether you can open a business in a particular country. Taxes vary depending on where you’re located. Some countries impose high taxes, while others offer low rates.

Once you understand your location’s tax requirements, you can apply for a tax ID number.

Your federal tax identification number is an Employer Identification Number or EIN. You can apply for an EID online through the Internal Revenue Service website. If you are applying for an individual EIN, you must provide personal information, including name, SSN, birth date, and address.

For corporate entities, you must provide contact information such as the names of officers and directors, principal place of business, mailing address, and telephone numbers.

Once you complete the application process, you will receive a confirmation email containing the EIN assigned to your business. You will use this number to file your federal tax return each year.

4. Open a Business Bank Account

Most businesses must open up a business bank account to receive payments from clients. The reason is that banks need proof of identity for both the business owner and anyone that will be signing off on the account. If you’re opening a business bank account without doing your research beforehand, it could be a costly mistake.

In most cases, you can assume that you’ll need the following:

- Valid ID for the business owner

- Proof of address for the business

- Three months of business statements

Some banks offer free document scanning services, while others allow you to submit documents via email.

5. Insure Your Company Aboard

Business owners sometimes overlook the importance of having business insurance. But it’s one of those things that can save your business in case something goes wrong. If you don’t have coverage, you could find yourself facing huge costs.

Here are two reasons why you need business insurance.

1. Natural Disasters: If you run a store, there’s always a chance that you might experience a natural disaster like a hurricane. A good business insurance plan can help you recover from a natural disaster.

2. Cover Theft: Theft isn’t limited to home invasions. There are many ways thieves can steal money from businesses. But with proper protection, you won’t lose anything.

Conclusion

If you want to set up a business abroad, you should follow these five steps. By taking the time to prepare ahead of time, you’ll make sure that your new venture runs smoothly.

4 thoughts on “5 Basic Requirements For Setting A Company Abroad”